The Short Report: July 3, 2024

GOVERNMENT FUNDING

The Government of Canada will provide Brampton, Ont.-based MDA Space with $999.8 million to continue work on Canadarm3 and begin detailed design, construction and testing. These are the last steps to finalize the design, construction and testing of the robotic system before delivering Canada’s contribution to Gateway, a small outpost that will orbit the Moon. (Artist's illustration at right). Gateway will be crewed for only a portion of the year, unlike the continuous presence of astronaut crews on the International Space Station. Canadarm3 will include a next-generation large robotic arm, a small dexterous arm and a set of specialized tools. Canadarm3 will serve as a critical component and will be used to maintain, repair and inspect Gateway, relocate modules, enable science in lunar orbit, help astronauts during spacewalks and capture spacecraft visiting the station. Much like Gateway itself, Canadarm3 operations will be highly autonomous, minimizing the need for direct human intervention, representing a leap forward in spacecraft capability. Canadarm3 is planned to launch no earlier than 2029. Canadian Space Agency

The Government of Canada will provide Brampton, Ont.-based MDA Space with $999.8 million to continue work on Canadarm3 and begin detailed design, construction and testing. These are the last steps to finalize the design, construction and testing of the robotic system before delivering Canada’s contribution to Gateway, a small outpost that will orbit the Moon. (Artist's illustration at right). Gateway will be crewed for only a portion of the year, unlike the continuous presence of astronaut crews on the International Space Station. Canadarm3 will include a next-generation large robotic arm, a small dexterous arm and a set of specialized tools. Canadarm3 will serve as a critical component and will be used to maintain, repair and inspect Gateway, relocate modules, enable science in lunar orbit, help astronauts during spacewalks and capture spacecraft visiting the station. Much like Gateway itself, Canadarm3 operations will be highly autonomous, minimizing the need for direct human intervention, representing a leap forward in spacecraft capability. Canadarm3 is planned to launch no earlier than 2029. Canadian Space Agency

The cost of Canada building two modern Polar icebreakers has increased to $8.5 billion, a $1.3-billion increase over the prior estimate by the Office of the Parliamentary Budget Officer (PMO), according to an update from the PMO. The first Polar icebreaker is expected to be delivered in 2030-31, and the second in 2032-33. This represents a one-year and two-year delay for the first and second vessels, respectively, compared with prior PMO work on this project in 2021. A one-year delay to both vessels is estimated to cost an additional $260 million, while a two-year delay is estimated to cost an additional $530 million, the PMO’s update said. The construction process is expected to span seven years. One of the Polar icebreakers will be built at Vancouver Shipyards, with construction scheduled to begin in 2024-25. The other vessel will be built at Chantier Davie Canada Incorporated (CDCI) in Quebec, with the PBO assuming construction will begin in 2026-2027. (Ottawa is currently in negotiations with CDCI for the second vessel to determine its construction timeline). The federal government launched the Polar Icebreaker Project in 2008 to replace the Canadian Coast Guard’s current fleet of heavy icebreakers with a new class of heavy icebreakers build to modern specifications. Each of the new Polar Class 2 Polar icebreakers will be 158 metres long, weigh 26,000 tonnes and carry a crew of 100 and two helicopters. In a response to the PMO’s update, the Canadian Coast Guard said in a statement that the initial costs were calculated based on the Polar icebreaker design from 2014. In 2022, the ship's design was improved to reflect the latest standards and technological innovations. “This necessary update has inevitably led to cost increases. That said, it will be better able to respond to the many missions of the Canadian Coast Guard, and for a longer period of time.” Parliamentary Budget Officer

More than $600 million in Canada Pension Plan funds are in China’s electric vehicle sector – which was accused of unfair trade practices by the federal cabinet. The Canada Pension Plan Investment Board disclosed it held $604 million in shares in the Chinese EV sector, according to a story by Blacklock’s Reporter, the only reporter-owned and operated newsroom in Ottawa. On June 24, Finance Minister Chrystia Freeland named the Chinese EV sector as predatory and announced a 30-day Customs Tariff review of trade practices in the electric auto market. On July 2, Finance Canada launched a 30-day consultation, from July 2, 2024, to August 1, 2024 on potential policy responses to protect Canada’s auto workers and its growing EV industry from unfair trade practices, and prevent trade diversion resulting from recent action taken by Canadian trading partners. “The government is also considering perspectives on policies driving China’s overcapacity and surging exports of EVs, including labour and environmental standards, and unfair and non-market practices.” Stock bought with Canada Pension Plan premiums included $287 million in Contemporary Amperex Technology Co. Ltd. of Fujian Province, the world’s largest electric auto battery manufacturer. Canadians also own $12 million worth of stock in Great Wall Motor Co., maker of Ora-brand electric cars. Other Pension Plan holdings include $116 million in automakers BYD Co., $69 million in Li Auto Inc., $26 million in Chongqing Changan Automobile Co. and $19 million Nio Inc. Millions more were put in battery manufacturers and suppliers including $13 million in Tianqi Lithium Corp., $7 million in Eve Energy Co. and $6 million in Ganfeng Lithium Group. The CPP board holds a total $7.5 billion worth of shares in Chinese companies of all types. A report last December by the Parliamentary Special Committee on Canada-China Relations urged the CPP board to pull investments from Chinese companies involved in unethical or illegal practices. Finance Canada said connected vehicles containing technology from China “pose significant risks to the privacy of Canadians, their data, and Canada’s national security interests. They collect information from drivers, yet lack transparency on data ownership.” Western Standard, Finance Canada

The Canada Foundation for Innovation (CFI) will provide more than $18 million to support 23 research infrastructure projects at 21 colleges, cégeps and polytechnics across the country. This contribution, made through the CFI’s College Fund, will help these institutions obtain the state-of-the-art labs and equipment they need to attract, train and inspire the next generation of innovators, and to build research collaborations with public, private and not-for-profit partners. This funding will support a range of applied research, including:

Resilient farms: CFI funding will help establish the Agriculture Biotechnology Cool Climate Centre at Nova Scotia Community College in Middleton, N.S. The centre will have controlled indoor and outdoor testing environments as well as equipment for assessing soil gas emissions and nutrient leaching. Research into bio-stimulants and soil amendments will help develop resilient crops and increase their yield.

Recycling fashion waste: In Quebec alone, more than 124,000 tonnes of textile waste are either sent to the landfill or incinerated every year. Researchers at Montréal’s Cégep Marie-Victorin’s affiliated non-profit Vestechpro will use CFI-funded equipment to develop a mechanical assembly line to recycle clothing and industry textiles.

Supporting skilled trades: Over the next 10 years, researchers at Conestoga College Institute of Technology and Advanced Learning in Cambridge, Ont., estimate a shortage of more than 170,000 workers in the province. To help build and sustain the workforce, they have identified challenges that need to be addressed, including high rates of injury, an aging workforce and barriers to job accessibility for underrepresented groups. The CFI is supporting CONSTRUCT: Centre for Ontario’s Network of Skilled Trade Researchers, Unions, Contractors, and Tradespeople with funding for equipment to measure workplace demands and hazards as well as workers’ physiological and cognitive responses. The information collected will help the research team collaborate with a range of partners to develop real-world solutions to reduce the risk of injury and attract a more diverse workforce. CFI

Export Development Canada will provide a loan to Kitimat, B.C.-based Cedar LNG of $400 million to $500 million for a liquified natural gas project led by the Haisla Nation on the Wes Coast. The Haisla have partnered with Calgary-based Pembina Pipeline Corp. on a floating LNG facility with a capacity of 3.3 million tonnes of natural gas per year. It is expected to be in service by late 2028. The partners announced a positive final investment decision on June 25 for the Cedar LNG Project. The Haisla have praised the project as a pathway to prosperity and self-reliance that will enable the First Nation to fund its social services and cultural programs without depending on federal payments. But Julia Levin, associate director of Environmental Defence, says federal subsidies to a new fossil fuel project are “disappointing to see,” given the Liberal government’s promise to phase out such subsidies. Clean Energy Canada says the Cedar LNG facility, even though it will be powered by B.C.’s hydroelectricity, will also generate an estimated 9 million tonnes of greenhouse gases, including about 8 million tonnes emitted after the gas reaches its market. Canada’s National Observer

Finance Canada announced the Canada Growth Fund’s fifth investment, a novel form of carbon contract for difference with Markham District Energy Inc. – the city’s public utility – to expand its clean energy services to more residents and businesses. Markham District Energy’s network delivers reliable, cost-efficient heating and cooling to over 15 million square feet across 240 buildings. Through a system of underground pipes, energy is delivered to buildings in the form of hot water and chilled water to heat and cool building space. This clean energy network is already attracting major new investments to Markham and reducing greenhouse gas emissions by 35 percent, with a target of net-zero by 2050. This carbon contract for difference will help Markham District Energy generate more clean energy by using Noventa Energy Partners Inc.’s Wastewater Energy Transfer (WET™) technology to extract thermal energy from wastewater. Over the 10-year carbon contract for difference, the project has the potential to reduce more than 177,000 tonnes of carbon dioxide equivalent (CO2e) emissions, with an initial price of $100 per tonne of CO2e. [Editor's note: Over 10 years, that amounts to a price of $177 million for 177,000 tonnes of CO2e]. Finance Canada

The Federal Economic Development Agency for Southern Ontario (FedDev Ontario) announced $18.4 million in repayable investments to eight food manufacturers across southern Ontario. The funding includes $3 million for Ottawa Valley Grain Products, a family-owned grain mill in the rural community of Carp. The investment will support the company to adopt new equipment as it establishes a new grain mill in Almonte. Other funding recipients are: Andriani Ltd., Aspire Bakeries, Baxter’s Bakery, Demetres Manufactory, O’Doughs, Picard Peanuts, and Schep’s Bakeries. The funding will enable the companies to expand production capabilities and adopting new cutting-edge equipment. FedDev Ontario

Environment and Climate Change Canada (ECCC) announced up to $10.9 million to support a first round of 32 projects approved for funding under Manitoba’s Merit-Based Program. The funding includes a $9.4-million federal investment from the Low Carbon Economy Fund and $1.5 million from the Government of Manitoba. The Manitoba Merit-Based Program is designed to fund projects that will:

- Reduce greenhouse gas emissions, including switching from the combustion of fossil fuels to renewable energy.

- Promote growth in the low-carbon economy and green job creation.

- Support industry competitiveness.

- Improve energy efficiency and reduce energy costs.

The 32 projects receiving funding include 24 projects from the agricultural sector, the majority of which still rely on propane or natural gas for irrigation, grain drying, and transfer and handling systems. This investment will help these projects upgrade or make the switch to renewable energy, the provincial government said. This will contribute to greenhouse gas emissions reductions of over 7,310 tonnes by 2030, which is equivalent to removing over 2,200 vehicles from Manitoba’s roads. Eight other projects are divided between not-for-profit organizations, social housing, and municipal development projects focused on fuel switching and reducing energy costs. ECCC

INOVAIT and the Government of Canada announced a $10.7-million investment in contributions to seven commercialization-focused R&D projects under the second iteration of INOVAIT’s Focus Fund program. The companies behind each project include Molli Surgical, IllumiSonics, Radialis, MIMOSA Diagnostics, Profound Medical, Rogue Research and Oncoustics, which each have academic or private partners in their projects. INOVAIT’s contributions to each project ranged from nearly $740,000 to nearly $2 million. Founded by the Sunnybrook Research Institute and supported by the federal Strategic Innovation Fund, INOVAIT is Canada’s network focused on advancing image-guided therapy (IGT) through the integration of artificial intelligence, big data and machine learning. IGT is the practice of using medical imaging to plan, perform and evaluate medical interventions. The seven selected projects will integrate machine learning capabilities into IGT technologies. Focus Fund project members will invest an additional $21.3 million into these projects, for a total of $32 million into the Canadian IGT sector. INOVAIT

The Pacific Economic Development Agency of Canada (PacifiCan) announced more than $3.1 million for Nanaimo, B.C.-based VMAC (Vehicle Mounted Air Compressors) to increase production of its air compressor technology, designed specifically for heavy-duty commercial vehicles. VMAC’s mobile compressors use patented technology to compress air, which is used to power commercial electric vehicle parts such as air brakes. This innovative technology allows for reduced fuel consumption, lower emissions and enhanced operational efficiency. With this funding, through PacifiCan’s Business Scale-up and Productivity program, VMAC will expand its manufacturing facility, install new machines, implement a marketing plan and hire new personnel. PacifiCan

The Federal Economic Development Agency of Southern Ontario (FedDev Ontario) announced a $2-million federal investment in the Oshawa-based Spark Commercialization and Innovation Centre, which provides support to early-stage and growing technology companies and innovation entrepreneurs. The Spark Centre’s new Landing-Pad Accelerator Program will offer a range of supports, including workshops and coaching to newcomer and female founders and skilled talent in environment, energy and engineering. With this investment, the Spark Centre will help entrepreneurs grow their businesses in areas such as emission reduction, biodiversity protection, electrification, smart mobility/technology, and renewable energy. The accelerator program will support 80 businesses to commercialize new products and provide mentoring to more than 200 entrepreneurs. The Collingwood, Ont.-based Georgian Bay Business Accelerator will receive a federal investment of $400,000 over three years, to support more than 35 businesses to commercialize new products and provide training/mentorship to 400 entrepreneurs. FedDev Ontario

Natural Resources Canada (NRCan) announced $353,710, through the Clean Energy for Rural and Remote Communities Program, to evaluate the potential of hydrokinetic turbines (used with free-flowing rivers, as well as tides, waves and ocean currents) for generating electricity in Deh Cho communities in the Northwest Territories. This initiative, led by Big River Service Centre LP in Fort Providence, N.W.T. in partnership with the Canadian Hydrokinetic Turbine Testing Centre in Seven Sisters Falls, Manitoba and Fort Providence-based Gonezu Energy Corporation, will involve the proponents conducting site assessments and fostering collaboration and engagement with local communities as they explore the possibility of a transition from diesel to hydrokinetic energy sources. NRCan

Innovation, Science and Economic Development Canada (ISED) announced the Consultation on Artificial Intelligence (AI) Compute, which will help inform the design and implementation of a new $2-billion AI Compute Access Fund and a Canadian AI Sovereign Compute Strategy proposed in Budget 2024. The consultation includes the AI Blueprint, a discussion paper that outlines Canada’s opportunity and ambition on AI. The consultation will engage Canadian researchers, innovators and businesses in identifying the best strategies for investing in Canada’s AI future, and it will be carried out through a range of means and venues, including online. The government will also engage civil society, Indigenous groups and other interested stakeholders. Submissions for this consultation will be accepted from June 26, 2024 to September 6, 2024. To participate in the consultation:

- Read the consultation document

- Fill in the survey(preferred) or alternatively, you can email your comments and feedback at aicompute-calculia@ised-isde.gc.ca

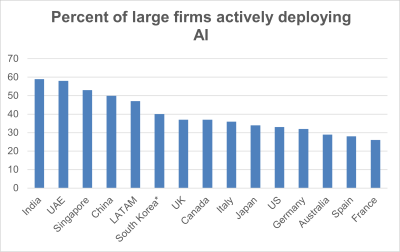

Canada is home to more than1,500 firms specializing in AI, as well as 20 public AI research labs, 75 AI incubators and accelerators, as well as 60 groups of AI investors from across the country, ISED said. The depth of Canada’s AI ecosystem also includes:

- Three percent of the world's top-tier AI researchers – ranking 6th globally

- 67-percent growth in women in AI in 2022-23

- highest year-over-year increase in the G7 for AI talent

- 1st in the G7 for AI-related scholarly output per capita since 2019

- 57-percent increase in AI patent filings by Canadians in 2022-23

- US$15.2 billion in venture capital attracted to the Canadian AI sector from 2012 to 2023.

According to ISED’s AI foundational blueprint, a multi-faceted approach is likely to employ elements of several models to inform the longer-term Sovereign Compute Strategy. These models include:

Partnering to develop new AI compute infrastructure – Investments in the development of net-new high performance computing infrastructure through a public-private partnership arrangement.

Leveraging the market power of AI developers – Providing funding directly to AI stakeholders or aggregating the demand of AI stakeholders, such as Canada's most promising AI development companies, to help grow the demand for Canadian-based compute capacity. In doing so, public funds would serve to help improve the business case for the private sector to invest in Canadian-based compute capacity.

Expand the capacity of compute infrastructure providers – Providing support to incentivize increases in the supply and availability of compute within Canada. Support could take the form of grants to help offset capital expenditures, or through tax or energy incentives. Investing directly to support providers for compute power in Canada could allow for faster scale-up of capacity and deliver increased compute availability to the Canadian market over the medium-term. ISED

RESEARCH, TECH NEWS & COLLABORATIONS

Concordia University, through its Volt-Age program, and Northvolt North America announced a memorandum of understanding that marks the beginning of a strategic collaboration. Key initiatives of the agreement include joint research on lithium-ion, lithium metal, and sodium batteries, the exchange of researchers and professionals, as well as the organization of scientific and industrial events. The new collaboration will also emphasize industrial and professional training, essential to meet the job market needs of Quebec and Canada in high-tech sectors such as batteries. Volt-Age officially launched its research program in October, 2023. Funded with $123 million from the Canada First Research Excellence Fund, the program brings together university research and innovation with expertise from the public and private sectors, industry and Indigenous communities. Its goal is to provide integrated and affordable decarbonization solutions. Volt-Age focuses on electrification, notably on energy storage, transport networks, energy systems, smart buildings, cybersecurity, and digital twins. A network of living labs involving citizen participation will promote the social adoption of innovations designed to accelerate Canada's transition to carbon neutrality by 2030. Concordia University

The McKenna Institute at the University of New Brunswick (UNB) announced the Rural Strategy for Digital Transformation to accelerate New Brunswick’s digital economy. This strategy is made possible by a $1 million investment over three years, led by the River Philip Foundation. The strategy proposes initiatives to increase digital adoption, public engagement and support for New Brunswick’s rural communities and smaller centres through skills development, digitalization initiatives and partnerships. The strategy also will provide best practices to employers, organizations and individuals on how to thrive in a digital interconnected economy and to lead the digital transformation in their communities. EY Canada will support the strategy with an in-kind donation as part of their Ripples Program, which connects EY people and their skills, experience and passions to not-for-profits and social enterprises to help deepen their impact on the lives of young people and underserved groups. With the help of this contribution, the McKenna Institute will lead a data collection and asset mapping exercise to identify the regional digital divide challenges and how technology can contribute to local economic growth. UNB

RRC Polytech in Winnipeg unveiled its new Indigenous entrepreneurship acceleration and incubation initiative, Mittohnee Pogo’ohtah (Mittohnee), in the Roundhouse of Manitou a bi Bii daziigae — the college’s downtown hub for technology, collaboration and community. A first of its kind in Manitoba, Mittohnee transforms experieontial learning, entrepreneurship and innovation into business opportunities for Indigenous Peoples in Manitoba. Mittohnee’s first director is Amy Jackson, a member of Opaskwayak Cree Nation, and a dedicated community connector and entrepreneur who founded online business Nativelovenotes. Mittohnee helps Indigenous students start their own businesses as they graduate out of RRC Polytech’s entrepreneurship-based Social Innovation and Community Development program. Mittohnee also supports established Indigenous entrepreneurs or band-operated businesses looking to pivot, scale up or enter new joint ventures by serving as an experienced, independent third party. The college’s ability to remove barriers and create better access for Indigenous entrepreneurs to become successful is made possible through partnerships with the federal and provincial governments, and corporate partners like TD Bank Group and Canada Life. In June, RRC Polytech received $1.5 million from the Government of Canada and $773,000 from the Government of Manitoba to support the Mittohnee project. RRC Polytech

Farm Credit Canada (FCC) announced a $5-million investment in the newly named FCC Accelerated Breeding Program at the Global Institute for Food Security (GIFS) at the University of Saskatchewan. Accelerated breeding combines technologies such as genomic selection, speed breeding, bioinformatics and computer simulation to increase the rate of genetic gain for crop and livestock breeding programs, delivering new products into the hands of producers two to three years faster and improving agronomics, quality and disease resistant traits. Deployed for more than 20 years in dairy and for more than a decade in crops such as corn and soybean through large corporations, the FCC Accelerated Breeding Program at GIFS will provide public and private breeders access to the same technologies not routinely available for crops and livestock important to Canada. By boosting Canadian agriculture’s productivity, competitiveness and sustainability, the program will help to bolster the country’s global position as a reliable and sustainable producer of food for the world. A 2023 report by FCC identifies a $30 billion opportunity over 10 years to rekindle Canada’s agriculture productivity growth, and highlights innovation and technology as a pathway to achieving this. FCC

Red Deer Polytechnic and Silicon Valley-headquartered SVG Ventures | THRIVE, a global venture and innovation firm, signed an agreement that will bring together entrepreneurs, industry experts, researchers and students to support economic growth and sustainability in Alberta at the intersection of the agriculture and energy sectors. The synergy between agriculture and energy is of increasing importance in Alberta, where these sectors are essential drivers of the provincial economy and also take the lead on the international stage. This memorandum confirms both parties’ mutual interest in working toward initiatives in central Alberta that bring awareness and build Alberta’s ag-energy innovation ecosystem for local and global impact. This includes fostering the startup, scaleup and applied research community at this nexus, and increasing competitiveness across central Alberta’s agriculture and energy industries through effective technology demonstration and adoption. Red Deer Polytechnic

Edmonton-based Applied Pharmaceutical Innovation (API) and the University of Alberta’s Li Ka Shing Applied Virology Institute have started construction on a new pharmaceutical manufacturing facility in the Edmonton Research Park. The Critical Medicines Production Centre (CMPC) is the cornerstone of the $200-million Canadian Critical Drug Initiative – a strategy devised in the wake of the COVID-19 pandemic to secure supply chain resilience and solidify Alberta’s and Canada’s position as a pharmaceutical leader. The 83,000+ square-foot facility will be unique in Canada with its ability to produce more than 70 million doses of a product a year and a critical sprint capacity to fill the needs of Canada in under 100 days. Benefits include improved patient access to needed medicines, enhanced hospital operations, and the addition of much-needed capacity to produce and manufacture therapeutic drugs here at home. One of the first products of the facility, Propofol, is a critical hospital drug. Shortages of Propofol can lead to surgery cancellations and delays. Investment in the facility included $80.5 million in federal funding through Prairies Economic Development Canada, $17.6 million from the Government of Alberta, and City of Edmonton approval of the lease required to build the CMPC in the Edmonton Research Park. Construction for the CMPC is set to be completed by 2026. API

Shell Canada Products, a subsidiary of Shell PLC, announced the final investment decision to build Polaris, a carbon capture project at the Shell Energy and Chemical Parks at Fort Saskatchewan about 40 kilometres northeast of Edmonton. Polaris is designed to capture approximately 650,000 tonnes of CO2 annually from the Shell-owned Scotford refinery and chemicals complex. Shell also announced the final investment decision to proceed with the Atlas Carbon Storage Hub, which includes a 22-kilometre pipeline to transport CO2 to two storage wells, in partnership with ATCO EnPower. The first phase of Atlas will provide permanent underground storage for CO2 captured by the Polaris project. Shell didn’t disclose the cost of the projects, but said both are expected to begin operations toward the end of 2028. Shell’s announcement comes just a few days after the federal government passed legislation implementing its carbon capture, storage and utilization investment tax credit (ITC), which offers a refundable ITC of up to 50 percent on carbon capture equipment and 37.5 percent on qualified carbon transportation, storage or usage equipment. Polaris and Atlas will build on the success of the Quest carbon capture and storage facility at Scotford, which has safely captured and stored more than nine million tonnes of CO2 since 2015 that would otherwise have been released into the atmosphere. Shell

Calgary-based Captus Generation, a subsidiary of BTG Energy in Calgary, announced plans to build new, carbon-neutral, natural gas-fired power generation facilities near Pincher Creek in southern Alberta. The development will supply reliable electricity to Alberta’s grid and potentially support on-site power-consuming businesses such as data centres. Captus Generation is exploring an opportunity to repurpose Pincher Creek’s historic depleted natural gas field to permanently store the associated carbon emissions using proven carbon capture and sequestration technology. The project site, approximately 20 kilometres south of Pincher Creek, already has an established natural gas supply and is connected to the grid via nearby high-voltage transmission lines. Carbon emissions captured during power generation will be permanently stored underground in a reservoir beneath the development, eliminating the need for a lengthy and costly pipeline. Initial plans include the construction of a full-scale, 200-megawatt power plant with potential for expansion. A final investment decision is expected in early 2025. Captus Generation

Lafarge Canada Inc., a member of Holcim Group, and Ottawa-based carbon technology firm Hyperion Global Energy Corp. announced the launch of Hyperion’s patented Tandem Carbon Recycling System© pilot project. Hyperion’s process captures and transforms carbon emissions into high-performance mineral components, used to make sustainable building solutions such as low-carbon concrete and other materials. The pilot project, currently operating at Lafarge’s Bath Cement Plant near Kingston, Ont., involves testing Hyperion’s net-zero mineral solutions for advanced concrete such as Lafarge’s ECOPact®, which can lower embedded carbon between 30 percent to 90 percent compared with standard concrete without any compromise in performance. The pilot project currently has the capacity to remove up to 1,000 tonnes of carbon dioxide annually from plant operations, with potential to scale the system 10 times larger over the next year. The joint effort will further develop and scale Hyperion’s recycling technology, a drop-in system that captures and transforms waste carbon emissions into high-purity minerals that permanently store carbon. Hyperion’s novel reactive mineralization process achieves up to 98-percent capture efficiency of carbon dioxide emissions, producing innovative mineral components that enhance the density and strength of concrete, among other industrial uses. Lafarge Canada

Calgary-based Enbridge Inc. and Six Nations Energy Development LP announced plans to develop a new wind energy project southeast of Weyburn, Saskatchewan. The project is backed by loan guarantees of up to $100 million from the Saskatchewan Indigenous Investment Finance Corporation. The First Nation and Métis partners have an opportunity to acquire equity ownership of at least 30 percent in the Project. Six Nations Energy Development is a newly-created consortium of Cowessess First Nation, George Gordon First Nation, Kahkewistahaw First Nation, Métis Nation-Saskatchewan, Pasqua First Nation and White Bear First Nations. The Seven Stars Energy Project is expected to produce 200 megawatts of emissions-free power – enough to support the annual energy needs of more than 100,000 Saskatchewan homes. It will be developed, constructed and operated by a wholly-owned indirect subsidiary of Enbridge. The project is targeted to be operational in 2027. Enbridge is working toward securing a long-term power purchase agreement with SaskPower to support final investment decisions, anticipated in 2025. Enbridge

The Buffalo Pound Water Treatment Corporation (BPWTC), the City of Regina and the City of Moose Jaw unveiled a $4-million solar power project at the Buffalo Pound Water Treatment Plant, about 30 kilometres northeast of Moose Jaw. The project will power the plant’s administration building, enabling the reduction of the facility’s energy consumption by approximately 10 percent. The solar panel installation is designed to generate 1,800 kilowatts of AC power. The system doesn’t include batteries or feed back into the SaskPower grid, so the solar power will be consumed solely by the water treatment plant. The initiative supports the City of Regina’s Energy and Sustainability Framework, which works to reduce energy use where possible and significantly increase energy efficiency before and while transitioning to renewable energy sources. The project also aligns with the City of Moose Jaw’s Climate Action Plan, a long-term, action-driven plan providing both economic and environmental impacts. Water Canada

Edmonton-based space technology company Wyvern is expanding its Dragonette constellation of satellites, leveraging San Francisco-based Loft Orbital’s space infrastructure to rapidly enhance Wyvern’s constellation’s capacity to meet the growing needs of customers for the company’s data and analysis of hyperspectral imaging. Wyvern won’t need to build, launch or operate additional satellites. Instead, Loft Orbital will provide the satellites and associated infrastructure. Wyvern has three 6U Dragonette satellites in orbit, launched last year aboard SpaceX rockets. Wyvern said its satellite constellation expansion will enable the company to serve a broader range of customers and use cases, including agriculture and environmental monitoring, mining prospecting, defense and disaster management. The expanded constellation not only increases data volume and coverage but also ensures improved revisit rates while providing the data with greater reliability and precision, Wyvern said. Loft will operate Wyvern’s missions onboard its space infrastructure, made up of satellites. Loft’s space infrastructure includes resources such as video, thermal and wide-swath imagers as well as radio frequency payloads. These high-performance satellite platforms enable rapid and affordable access to novel datasets, like hyperspectral imagery. Wyvern

SaskTel, Samsung Canada, and Innovation Saskatchewan announced the launch of Saskatchewan’s first-ever 5G Innovation Labs. Named the SaskTel 5G Innovation Lab – powered by Samsung, these new labs are purposefully designed and equipped to provide local businesses, university students, researchers and other innovators with the tools and facilities needed to unlock the full potential of 5G technology and develop innovative solutions that will shape the future of communication and connectivity across Saskatchewan. 5G technology, which delivers hyper-fast data speeds, is expected to benefit the agricultural, mining and oil and gas industries, along with smart cities, among others. The 5G Innovation Labs are located at the Collider co-working spaces in Saskatoon and Regina, part of the Innovation Place research and technology parks, and close to the province’s largest post-secondary institutions. Samsung Canada

Calgary-based PrePad, which develops cloud-based software focused on revolutionizing oil and gas drilling, was named Disruptive Digital Innovator at the Global Energy Show Calgary in Calgary. PrePad offers advanced simulation capabilities, which enables clients to move beyond traditional spreadsheet-based approaches. In April, PrePad received a strategic investment of an undisclosed amount from U.S.-based Devon Energy Corporation, which is using PrePad’s technology. PrePad was co-founded in 2021 by Hervo and Brandon Eidson, who both had worked at Shell Canada. Calgary.tech

VC, PRIVATE INVESTMENT & ACQUISITIONS

Toronto-based e-Zinc, which enables sustainable, long-duration energy storage with its zinc-air battery, announced it raised $42 million in follow-on funding to its Series A round. This Series A2 round was led by Evok Innovations, with additional investments from Mitsubishi Heavy Industries, Export Development Canada, and Ultratech Capital Partners. e-Zinc’s existing shareholders also participated, including Toyota Ventures, Eni Next, Anzu Partners, BDC, and Graphite Ventures. e-Zinc plans to use this financing to accelerate product development and complete the construction of its 42,000-sq.-ft. pilot manufacturing facility in Mississauga, Ont. e-Zinc has partnered with Toyota Tsusho Cananda Inc. and the California Energy Commission to demonstrate how e-Zinc’s energy storage systems can reliably provide long-duration energy storage at commercial scale. By using this new investment to carry out these field demonstration projects, e-Zinc will validate that its zinc-air batteries have the capability to store 24 hours of energy, which is approximately 10 times that of traditional batteries. e-Zinc

Montreal-based Cycle Capital and H2O Innovation announced the close of the $30-milliion Cycle H2O Fund, a venture capital fund dedicated to investing in innovative water technologies. The Government of Québec, through Investissement Québec, acted as anchor investor and was joined by Boann Social Impact, Fonds Climat du Grand Montréal, The Atmospheric Fund, a number of family offices, and private investors as limited partners. The fund aims to support the development and commercialization of seed and early-stage innovative water-tech companies from Québec and Eastern Canada (in sustainable agriculture, green chemistry and water treatment digital technologies related to industrial water processes and water conservation) to meet the growing need for market-ready solutions. Cycle Capital

Toronto-based IGM Technology, which provides financial software to state and local governments, announced a strategic growth investment from New York City-based growth equity firm Lead Edge Capital. The amount of the investment wasn’t disclosed. This strategic investment represents IGM’s first institutional capital raise and the funding will help accelerate growth through investments in product and operations, the company said. IGM’s cloud-based platform, Gravity, is used by governments and enterprises to comply with complex regulatory reporting and transparency requirements. Business Wire

Quebec City-based Gaiia, which offers an operating system for internet service providers, raised $18 million in a Series A funding round. The round was led by Inovia Capital with participation from new investors GTMfund, General Advance, Simon De Baene and Manon Brouillette (ex-CEO of Videotron and Verizon Consumer Group) as well as existing investor YCombinator. Gaiia’s platform includes a suite of tools such as marketing automation, messaging, online checkout, customer relationship managing, scheduling, and field service management. The company intends to use the funds to scale and serve customers across North America, Europe and Latin America. FinSMEs

Ottawa-based connected car startup Raven Connected raised $10 million in a Series A round of financing led by TELUS Global Ventures and which included Export Development Canada and existing investors Celtic House Venture Partners and Graphite Ventures. Raven is developing AI and emerging Internet of Things vehicle technology that includes live GPS tracking, vehicle diagnostics, and a dual dash cam to help fleet and smart city operators monitor and analyze their vehicles and drivers. Raven said the funding will accelerate the company’s initiatives to enable AI for video telematics and smart city applications with even more advanced AI and machine vision functionality. Raven will also use the funding to expand its suite of third-party integration partners and improve road safety and insurance outcomes, and to grow its workforce by more than 25 percent over the coming year. Raven Connected

CIBC Innovation Banking announced $10 million in growth capital financing for Vancouver-based software company Clariti. This funding will accelerate the development of new product features, support the ongoing integration of permitting technology provider Camino (acquired by Clariti in 2023), and be reinvested in customer service teams to support the company’s growing customer base across North America. Clariti’s platform helps local governments of all sizes simplify the permitting process, from pre-application to review and approval. Business Wire

Toronto-based legaltech startup Haloo closed a $4.7-million, all-equity, early Series A funding found. The round was led by Boston-based AI-focused venture capital firm Innospark Ventures. Other participants included BDC through its women-focused Thrive platform, LOI Venture (co-founded by Hootsuite founder Ryan Holmes and New Avenue Capital founder Manny Padda), and existing investor W Fund. Haloo recently pivoted its business model, shifting from assisting small businesses in conducting professional-quality trademark searchers and filing trademark applications, to offering its solution under an enterprise software-as-a-service model. Haloo plans to use the funding to scale the company and strengthen its sales, marketing and recruiting efforts. n24

Toronto-based Healwell AI Inc., a health care technology company focused on AI and data science for preventative care, invested $2.7 million in a financing round of X.AI Corp., an AI company founded last year by Elon Musk. Healwell made this investment through Think 1st Principles, an investment fund founded by Healwell shareholder and strategic advisor Massimo Agostinelli, which is the “Muskonomy” arm (Elon Musk oriented fund) of the Agostinelli Family Office backed by billionaire patriarch Robert F. Agostinelli of Rhone Group. With this investment, Healwell said it will have access to the closed xAI Developer Program with an opportunity to leverage xAI resources and expertise, including various large language models that have the potential to enhance the Healwell’s product development efforts. Healwell

Vancouver-based startup Topicflow, which develops an AI-powered performance management platform, announced $2.5 million in seed funding. The round was led by Founders' Co-Op with participation from Ascend. The company's platform leverages AI to assist managers in tracking goals, key performance indicators, action items, feedback and coaching conversations. The Topicflow team previously founded 7Geese, a continuous performance management company that was acquired in 2020 by Paycor. The funding in part will be used for hiring in engineering, data science, design and customer success to scale the onboarding of new customers. Accesswire

Vancouver-based Northstar Clean Technologies Inc. announced the closing of a $2.25-million strategic investment from two Calgary-based strategic investors. One investor is the Chiu family, a Calgary-based family and owner of homebuilding company Trico Homes. Northstar appointed Patrick Chiu, president of Trico Communities, to Northstar’s board of directors. Northstar is keeping the other investor anonymous. The company intends to use the proceeds for general corporate purposes and added contingency for Northstar's proposed asphalt shingle reprocessing facility in Calgary. Northstar received a $200,000 grant from Alberta Innovates to do detailed design engineering for its facility, expected to keep up to 200 tonnes per day of used asphalt shingles out of landfills. Northstar Clean Technologies

Halifax-based Innerlogic, an AI-powered culture intelligence company, raised $1.3 million in a seed funding round led by Concrete Ventures with Tidal Venture Partners, Techstars, and Middle Cove Capital as follow-on funds. Innerlogic founders Bryce Tully, CEO, and Mike Bawol, president and chief operating officer, have leveraged their combined experiences working for Team Canada at four different Olympic Games empowering high-performance teams. Innerlogic’s AI-powered software-as-a-service platform provides businesses with company-tailored analysis and reporting, behaviour-based coaching actions, and company alignment and accountability mechanisms. Innerlogic plans to use the funds for sales and marketing, go-to-market efforts, and product development. Innerlogic

Vancouver-based health care software company CloudMD Software & Services announced its shareholders approved a proposed deal to be acquired and taken private by Toronto-based equity firm CPS Capital. Each CloudMD shareholder will receive four cents per share for each share held – paying out around $12 million to shareholders. CloudMD will seek a final order of the Supreme Court of British Columbia, at a hearing expected to be held on July 3, to approve the deal. CloudMD

Montreal-based Nesto, a digital mortgage lender, announced the acquisition of Vancouver-based CMLS Group, the third-largest mortgage financing company in Canada. Nesto said the acquisition creates the largest technology-enabled lender in Canada. Financial details of the transaction weren’t disclosed. The combined entity will administer residential and commercial mortgages, with over 1,000 employees across 10 offices and more than $60 billion in mortgages under administration. The transaction was supported by investments from Diagram Ventures, Portage, NAventures (National Bank of Canada’s corporate venture capital arm), IGM Financial, BMO Capital Partners, Fonds de solidarité FTQ and Fondaction. All CMLS Group executives and employees will transition to the combined entity, which will be headed by Nesto CEO Malik Yacoubi, while CMLS CEO Sam Brown will continue as the company’s president and head of its commercial division. and CMLS shareholders will have an equity stake in the combined entity. Nesto

Australia-based Paladin Energy announced plans to acquire Kelowna, B.C.-based Fission Uranium in a transaction valued at $1.14 billion. Under the terms of the agreement, Paladin will acquire 100 percent of the issued and outstanding shares of Fission, while Fission shareholders will receive 0.1076 fully paid shares of Paladin for each Fission share that they hold. Once the transaction is complete, Fission shareholders will own approximately 24 percent of the combined entity, while Paladin shareholders will account for the remaining 76 percent. Fission Uranium, a minerals exploration company, is focused on developing a high-grade uranium mine and mill in the Athabasca Basin region of Saskatchewan. Paladin CEO Ian Purdy said the acquisition is part of the company’s strategy to diversify and grow into a global uranium leader across the top uranium mining jurisdictions of Canada, Namibia and Australia. The World Nuclear Association's latest nuclear fuel report indicates that uranium demand could grow by 28 percent from 2023 to 2030, which corresponds to an 18 percent rise in nuclear reactor capacity. Nasdaq

Toronto-based asset manager Brookfield Asset Manager is acquiring a 53-percent majority stake in Neoen, a Paris, France-based clean energy developer, for around US$43 per share. Brookfield signed the agreement with French investment company Impala, Fonds Strategique de Participations managed by ISALT, Cartusia, Xavier Barbaro, and other shareholders. The deal values Neoen as a whole at approximately US$6.5 billion. Neoen owns a portfolio of wind, solar and energy-storage assets spread across 16 countries. Brookfield, which in May announced it would acquire the stake alongside its subsidiary Brookfield Renewable and Singaporian sovereign-wealth fund Temasek, will assume about 8.3 gigawatts of emissions-free power generation with the takeover. Neoen

REPORTS & POLICIES

Investors play a pivotal role in ensuring responsible AI development and deployment: World Economic Forum report

The world needs a dynamic framework for artificial intelligence governance with universally accepted measures of this framework’s effectiveness, says a white paper by the World Economic Forum.

Companies also need to give appropriate attention to responsible AI, rather than deploy AI in pursuit of short-gains, or they will put long-term value at risk, according to the report, “Responsible AI Playbook for Investors.”

“For investors, building a resilient investment portfolio will involve staying ahead of AI developments,” says the report, produced in collaboration with CPP Investments Insights Institute. It offers a playbook for how investors can accelerate the adoption of responsible artificial intelligence to help drive value.

“The early excitement surrounding generative AI’s potential, while justified, ought to be balanced with a longer-term, prudent approach to foundational concerns,” Cathy Li, a member of the World Forum’s Executive Committee, and Judy Wade, a managing director at CPP Investments, said in a foreword to the report.

The broader business community is already struggling with risks such as data breaches, privacy loss, job loss, ethical challenges, misinformation and disinformation, they said.

“To protect their portfolios’ stability both now and in the future, investors should tackle both these immediate issues as well as the deeper implications of AI,” they said. This starts with establishing strong governance frameworks and clear principles and practices to integrate responsible AI standards into all applications.

Large investors can and should exercise the influence afforded by their capital to promote the use of responsible AI in their portfolios, in their work with investment partners, and in the ecosystem at large, Li and Wade said.

“For large investors, ensuring all AI applications are responsible (i.e. honest, helpful and harmless) is not merely a technological upgrade but a strategic imperative,” the report says.

Responsible artificial intelligence, based on the definition used in the report, adheres to principles of validity and reliability, safety, fairness, security and resilience, accountability and transparency, explainability and interpretability, and privacy.

According to the report, responsible artificial intelligence (RAI) reduces risk and promotes growth in the following ways:

- It addresses non-regulatory business risks. The adoption of AI carries risks of unintended consequences across ethical (social) and technological dimensions, such as new types of cyberattacks, unwanted biases, job disruptions and/or displacement, and data leaks or data poisoning. A comprehensive RAI strategy can help identify and mitigate these risks.

- It mitigates legal and regulatory risks. A proactive RAI framework can anticipate and adapt to legal and regulatory changes, safeguarding businesses and their investors from fines and reputational harm.

- It can improve top- and bottom-line growth. Studies indicate RAI can increase customer trust and, therefore, engagement and retention. It can also protect brand safety, broaden revenue streams, offer procurement advantages in competitive bidding processes, and increase pricing power in the marketplace, outperforming AI systems and businesses less aligned with RAI.

To capitalize on AI’s potential, the report says, investors should engage with stakeholders, including:

- Corporate boards: By engaging with boards of portfolio companies, direct investors can help establish (or hold directors accountable for establishing) RAI principles, policies and accountability measures.

- Investment partners: Asset owners can encourage investment partners to adopt AI governance in their own operations and extend it into their holdings.

- The broader ecosystem: Over a longer period, investors’ efforts can help create an ecosystem where the benefits of RAI are well understood and adoption is ubiquitous.

The report suggests several steps investors can take in engaging with companies, external asset managers and the broader ecosystem, including:

- Step 1: Develop RAI commitments and apply RAI principles and practices to internal operations. The first step for investors looking to integrate RAI across their portfolios is to become knowledgeable on AI/RAI and apply it to their own operations.

- Step 2: Conduct RAI due diligence on the portfolio. [The report offers several due diligence tools and resources, along with case studies]. AI will soon be at play in nearly all companies, from the innovation labs of big tech to factory floors. Investors should perform proper due diligence to assess how companies and investment partners are positioned to meet RAI principles.

- Step 3: Engage with companies, external managers and the broader ecosystem.

Along with the need for AI governance and standardized RAI metrics, there is a need for education and capacity building, the report says. To keep pace with AI advancements, stakeholders must invest in continuous learning. This includes executive education, forums for investor dialogue and public awareness initiatives.

CPP Investments’ Policy on Sustainable Investing includes deployment of AI and data and cyber security as sustainability-related factors, in delivering superior long-term investment outcomes according to sustainable investment principles.

According to a 2023 McKinsey & Company report, AI’s potential impact on the global economy could be upwards of $25.6 trillion annually.

However, AI risks can lead to significant unintended or maliciously intended negative consequences or harms for organizations and their investors, notes the World Economic Forum-CPP Investments Insights Institute report. “These harms can impact financial performance, non-financial performance, legal and compliance issues, and reputational integrity.”

For instance, Seattle-based Zillow lost approximately $881 million on its Zillow Offers home-flipping business in 2021 when its AI models did not adjust in tandem with a cooling housing market.

When it comes to AI governance, since 2016 countries have passed at least 148 AI-related bills, with the majority passed in recent years, the report says. The European Union AI Act, which currently represents the most stringent AI regulation, aims to create a risk-based approach to governing the technology.

A study by Boston Consulting Group found that companies that prioritize responsibility in expanding their AI capabilities experience nearly 30 percent fewer AI failures, compared with companies that do not.

Also, companies with mature RAI programs have double the chance of realizing a business “benefit” – such as better products or services or accelerated innovation – from their AI investment, regardless of their AI maturity.

“The transformative potential of AI is undeniable, and with this potential comes a compelling economic rationale for prioritizing RAI,” the report says.

“Investors play a pivotal role in this endeavour. By championing RAI, they not only help mitigate risks but also unlock opportunities for sustainable growth and innovation.” World Economic Forum

*******************************************************************************************************************************

Canada needs a federally led national strategy to develop nuclear fusion energy: industry report

Canada needs a federally led national strategy for nuclear fusion energy and strategic investment at a globally competitive level, says an industry report led by Canadian Nuclear Laboratories (CNL).

Fusion, in combination with conventional nuclear fission energy and renewables, can ensure that Canada achieves net-zero emissions by 2050, according to the report, “Fusion Energy for Canada: A Forward-Looking Vision and Call for Action.”

“For Canada’s nascent fusion industry to deliver sustainable and enduring impact, the challenges and opportunities must be understood across the policy, market, technical, and supply chain domains,” the report says. “The lack of a fusion strategy in Canada hinders R&D and growth of the industry.”

Fusion can provide multiple decarbonization pathways through the production of clean, secure and reliable electricity and industrial heat, and aligns with the national clean energy strategy, the report says. Fusion could help reduce Canada’s cumulative emissions by between 75 million tonnes (Mt) of carbon dioxide equivalent (CO2 e) and 192 Mt of CO2e by 2100.

“Without strategic national investment at a globally competitive level, Canada risks falling behind and failing to capitalize on economic, social, geopolitical and decarbonization opportunities that commercial fusion unlocks,” the Fusion Industry Association said in a statement.

Fusion development can drive new jobs, economic growth, intellectual property and innovation, according to the report..

Building and operating domestic fusion power plants, and exporting products and services for international experiments and plants, could create over 63,000 Canadian jobs and establish supply chains by 2050, the report says. From $232 billion to $520 billion in cumulative economic benefits are estimated by 2100, and Canada could access export markets with a cumulative value of over $147 billion by 2100.

As an established world leader in fusion policy and technology development, Canada can strengthen its reputation as a trusted partner in multilateral collaborations, the report says. There is also an opportunity to reinforce its leadership in developing nuclear non-proliferation safeguards and tritium regulatory and export frameworks.

Nuclear fusion creates energy like the Sun and other stars do: by smashing atomic particles together at immense speeds and temperatures within a confined “core” space, creating a plasma. In contrast, conventional nuclear fission reactions split atoms to create energy.

Fusion has been talked about as the next breakthrough source of clean energy for decades. However, a commercial fusion reactor connected to and providing power to an electricity grid has yet to be built anywhere in the world.

Key areas that need further development include the extraction of energy from the fusion reactions to generate electricity, the fusion fuel cycle, the formation and sustainment of fusion plasmas, and tritium production, extraction, and removal, according to the report.

In addition to ensuring the materials like metals and alloys necessary for the fusion fuel cycle and tritium production are available, the raw materials supply chain for these components also needs to be in place to sustain the operation of the plant.

There have been some recent scientific breakthroughs, including a 2022 news report that the U.S. Department of Energy’s Lawrence Livermore National Laboratory, located near San Francisco, produced a fusion reaction that generated more energy than it consumed – according to an anonymous researcher.

Vancouver-based General Fusion Energy announced in December 2022 that it had demonstrated plasma energy confinement times (10 milliseconds), temperatures (3 million degrees Celsius) and compression system performance that support meeting the company's goal of 10 keV (100 million degrees Celsius), in its 70-percent scale commercial machine at the UK Atomic Energy Authority’s Culham Campus.

CNL, based in Chalk River, Ont., argues in its report that the time is right now for Canada to invest in commercial fusion energy, because of:

- Rapidly growing global market: The market pull for commercial fusion has grown rapidly in the last five years. More than 43 private fusion companies operate globally, attracting more than $8.2 billion in funding, with Canada‘s General Fusion one of the earliest and most successful. Early-mover advantage is critical to capturing global market share.

- Recent advances in R&D: Fusion R&D is rapidly accelerating in maturity with advances in electronics, super-conducting magnets, materials, advanced lasers, AI and computing/modelling capabilities. Canadian tritium handling capabilities are driving advances in fuel management systems. The development of fusion power plants has moved beyond proving the science to solving engineering problems through to the current building of demonstration plants/prototypes (98 operating globally, 13 under construction and 33 more planned).

- Need to boost global investor confidence: Canada is globally recognized as a burgeoning hub for fusion innovation, attracting business investment and collaborating with industry and research facilities and universities globally. A dedicated national program would signal government confidence in the potential of fusion, acting as a multiplier for further investment.

- An opportunity for impactful investment: All G7 members are aggressively investing in dedicated national fusion programs and private industry, developing supportive policies and regulations, and/or hosting major fusion projects. Canada risks falling further behind if it does not act now. Currently, Canada provides the least government support for fusion development on a per capita basis among G7 nations.

- Critical Canadian strengths: Despite the lack of funding and a national policy, Canada has continued to contribute to fusion development and collaborations. It can build on the following strengths:

- A key source of tritium to supply fuel for fusion demos and early power plants.

- World-leading expertise in tritium handling, recycling and storage – essential to the fuel cycle of fusion power plants.

- Strong nuclear industry capabilities that can be adapted for fusion development (e.g. robotics, remote handling, irradiation, materials science, reactor physics, waste management and nuclear plant operations).

- A long history of safety, with strong tritium policies and a key role in the nuclear non-proliferation treaty.

- Well-established fusion developers (such as General Fusion) and national labs (such as TRIUMF).

The report sets out a “roadmap” proposed by key fusion players, including CNL and Atomic Energy of Canada Limited, the federal Crown corporation that owns CNL, for nuclear fusion development in Canada. In the near term (2024 to 2034), the roadmap proposes a demonstration of fusion power plants in Canada and/or elsewhere in North America, Europe and Asia.

In the medium term (2035 to 2050), there would be adoption of fusion energy in Canada and select regions, with transition to commercialization of the technology.

In the long term (2050 and beyond), there would be expansion of fusion energy in Canada and globally across all continents.

As for next steps, the report recommends key fusion ecosystem players sit down with the government to discuss, adapt and enhance the preliminary strategy roadmap. Canadian Nuclear Laboratories

*******************************************************************************************************************************

Saskatchewan government announces it won’t be complying with federal Clean Electricity Regulations

The Government of Saskatchewan announced it will not be complying with the federal government’s Clean Electricity Regulations (CER) when they come into effect.

The decision follows the release of the Saskatchewan Economic Impact Assessment Tribunal’s report on the CER.

According to the tribunal's report, Saskatchewan's economic growth would be at least $7.1 billion lower, the province would lose at least 4,200 jobs, and there would be an $8.1-billion negative effect on Saskatchewan’s export sector under the CER – expected to come into effect on January 1, 2025.

“This report offers irrefutable, independent evidence that these federal regulations will have a substantial impact on the cost of electricity in Saskatchewan and, as a consequence, our economy and way of life," Justice Minister and Attorney General Bronwyn Eyre said. "We cannot participate in federal economic harm to our province."

The tribunal compared the CER to Saskatchewan's Affordable Power Plan to reach net-zero electricity by 2050. The tribunal was also asked to examine the forecasted collective effect of the CER on the provincial economy to the end of 2035.

The tribunal found that regional differences between provinces, including power sources, population, climate and geography, were not taken into account when the federal government developed the CER. The tribunal identified a wide variety of impacts on the Saskatchewan economy, including:

- By 2035, residential ratepayers would face a $241 increase in additional electricity costs and a $630 increase by 2050. Households would have between $1,350 to $2,040 less to spend annually.

- By 2035, commercial ratepayers would face a $888 increase in additional electricity costs and a $2,340 increase by 2050.

- By 2035, small industrial ratepayers would face a $1,429 increase in additional electricity costs and a $3,750 increase by 2050.

- Saskatchewan has only three percent of Canada’s population, but would bear at least 15 percent of the total costs of CER compliance.

- Saskatchewan and its industries are particularly vulnerable to the consequences of greater electricity costs due to our resource and export-based economy.

- Complying with the CER would lead to stalled growth, potential shifts of production to jurisdictions with less stringent environmental standards, and a substantial decrease in royalties and taxes paid to the Government of Saskatchewan.

- Taxpayer-funded power infrastructure would have to be abandoned prior to its intended end-of-life.

Saskatchewan’s position is that the onus is now on the federal government to prove the constitutionality of the CER before it imposes these regulations on Saskatchewan.

“We will not be submitting taxpayers to the cost of litigation against the federal government unless litigated against," Eyre said. "The federal government is well aware that laws with respect to the generation and production of electrical energy fall under exclusive provincial jurisdiction in section 92A of the Constitution Act, 1867.”

The tribunal is currently examining the economic cost of the proposed federal oil and gas emissions cap and federal "

"Methane 75" regulations.

The office of federal Environment Minister Steven Guilbeault said, in a statement to CBC Saskatchewan, that the province’s decision is not surprising but called the reasons “incorrect conclusions.”

Guilbeault's office accused Saskatchewan of launching the tribunal with an "underlying ideological agenda" to build a political fight with the federal government. The tribunal’s report considers an outdated draft version of the CER, the statement said.

The tribunal’s report fails to acknowledge “the significant flexibilities that we have proposed and have been consulting on since earlier this year,” and ignores the $40 billion offered by the federal government in the 2023 federal budget to help provinces build a cleaner grid, Guilbeault’s office said.

"The results of this report are wildly out of sync with all the benefits we know come with building out a cleaner grid. Saskatchewan is ideally situated to be a leader in these economic opportunities," said the statement.

The Alberta government also is opposed to the CER and the oil and gas emissions cap. Govt. of Saskatchewan, CBC News

*******************************************************************************************************************************

Habitual entrepreneurs have differences in brain grey matter volume compared with managers: study

Researchers have found links between entrepreneurial behavior and brain structure, according to a study led by the University of Liège in Belgium.

The study, which included a researcher from Laval University in Quebec, found that entrepreneurs have differences in brain structure and grey matter volume compared with managers.

Habitual entrepreneurs, who repeatedly launch new ventures either simultaneously or sequentially, show an increase in grey matter volume in the left insula compared with managers. This brain region is associated with enhanced cognitive ability and divergent thinking – essential traits in entrepreneurship.

“This finding suggests that the brains of habitual entrepreneurs are specially adapted to foster the cognitive flexibility needed to identify and exploit new opportunities,” said Steven Laureys, Canada Excellence Research Chair in Integrative Neuroscience for Sustainable Mental Health, and neurologist at the CERVO Brain Research Centre at Laval University and at the University of Liège.

The study, “Entrepreneurial neuroanatomy: Exploring gray matter volume in habitual entrepreneurs,” was published in the Journal of Business Venturing Insights.

The study used a two-stage methodology. First, researchers collected self-reported measures of cognitive flexibility from 727 participants, including entrepreneurs and managers.

Next, researchers performed structural magnetic resonance imaging on a subset of these participants to explore differences in grey matter volume in the brain.

“This multidisciplinary approach enabled us to correlate self-reported cognitive flexibility with actual brain structure,” said Frédéric Ooms, assistant professor of innovation and entrepreneurship at HEC Liège at the University of Liège, and first author of the study.

Previous studies have found positive associations between cognitive flexibility and both entrepreneurial intentions and alertness, and the importance of cognitive flexibility for the initiative and progression of entrepreneurial ventures.

Studies have also shown that cognitive flexibility contributes to increases in creativity, innovativeness and information-search activities.

This new research has practical implications for educators and organizations, researchers said. By recognizing the importance of cognitive flexibility, educational programs can be designed to cultivate this characteristic in aspiring entrepreneurs. Organizations can also benefit by fostering cognitive flexibility among managers, which could lead to more innovative and adaptive business strategies.

The discovery of distinct neural characteristics in habitual entrepreneurs not only advances our understanding of entrepreneurial cognition, but also opens up new avenues of research into how these brain structures develop and change in response to entrepreneurial activities, the researchers said.

Are the observed differences born or made? Do early experiences in entrepreneurship lead to changes in the brain that can promote habitual entrepreneurship later in life?

Longitudinal studies are underway to explore whether these differences result from innate predispositions or the brain’s “plastic response” to entrepreneurial experiences.

This research also highlights the importance of combining neuroscience with traditional entrepreneurship studies to gain a comprehensive understanding of what makes successful entrepreneurs distinct at the neurological level, Ooms said. “As we continue to explore the role of the brain in entrepreneurship, this study represents an important advance in the field of neuro-entrepreneurship.” EurekAlert!

*******************************************************************************************************************************

New federal regulations aim to reduce methane emissions from landfills

Environment and Climate Change Canada announced publication of the proposed Regulations Respecting the Reduction in the Release of Methane (Waste Sector).

The proposed regulations would require landfills to control methane emissions and ensure landfill gas-recovery systems capture as much methane as possible.

In 2021, emissions from Canada’s landfills accounted for 19 percent of national methane emissions and 2.5 percent of national greenhouse gas emissions.

Methane is a potent greenhouse gas with 28 times more global warming potential than carbon dioxide over a 100-year period. Reducing methane emissions from all sources, including landfills, is one of the fastest and most cost-effective ways to combat climate change.

The proposed regulations would provide a consistent regulatory approach to reduce landfill methane emissions across the country in publicly and privately-owned landfills that have received municipal solid waste.

More specifically, owners and operators of regulated landfills that are estimated to generate methane above regulation thresholds would be required to comply with and monitor methane concentration limits on the landfill surface, limit venting of methane to the atmosphere, and detect and repair methane leaks.

To help assist with compliance costs that some landfills may incur, the Canada Community-Building Fund provides $2.4 billion in funding every year to provinces and territories who, in turn, distribute this funding to communities for strategic investments in essential infrastructure, including solid waste management infrastructure. This funding could support communities who develop landfill gas management infrastructure projects to comply with the proposed regulations.

According to ECCC, the costs of the proposed regulations from 2025 to 2040 amounts to $581 million, while during the same period the regulations are expected to generate a total benefit of more than $11 billion and a net benefit of nearly $10.6 billion. On average, the cost per tonne of GHG reduction is projected to be approximately $5 per ton of CO2e.

The proposed regulations aim to reduce methane emissions from Canadian landfills by about 50 percent by 2030 (from 2019 levels), while the cumulative GHG reductions from 2025 to 2040 are estimated to be 107 million tonnes of CO2 equivalent.

The regulations would contribute to Canada’s commitment to reducing global methane emissions by at least 30 percent below 2020 levels under the Global Methane Pledge. They would also help Canada reach its emissions reduction target of 40 per cent to 45 percent below 2005 levels by 2030 and net-zero emissions by 2050.

Stakeholders, interested parties, and Canadians are invited to review the proposed regulations and provide feedback by August 28, 2024. ECCC

*******************************************************************************************************************************

Carbon dioxide removal technologies must be rapidly scaled up to limit global warming: report

The world will need to remove around 7 billion to 9 billion tonnes of carbon dioxide (CO2) per year from the atmosphere by 2050 in order to meet the Paris Agreement target to limit global warming to 1.5 degrees Celsius, according to a new international report.

Currently, only 2 billion tonnes of CO2 per year are being removed by carbon dioxide removal (CDR) approaches through conventional methods like tree planting, the report says.

Novel CDR methods – like biochar, enhanced rock weathering, direct air carbon capture and storage, and bioenergy with carbon capture and storage – contribute just 1.3 million tonnes per year, less than 0.1 per cent of the total. Methods which are effectively permanent account for only 0.6 million tonnes per year – less than 0.05 per cent of the total.

The joint report is by the International Institute for Applied Systems Analysis in Austria, the German Institute for International and Security Affairs, the Mercator Research Institute on Global Commons and Climate Change in Berlin, and the Robert M. La Follette School of Public Affairs at University of Wisconsin-Madison.

“A diverse range of CDR methods must be rapidly scaled up to address climate change in line with the Paris Agreement,” the report’s authors said.

Although Canada is considered an international leader in carbon capture and storage (CCS), with seven commercial CCS facilities (five of which are related to the oil and gas sector), the report points out that CCS is not the same as CDR. To count as CDR, a method or technology must capture CO2 from the atmosphere.

Canada’s current CCS facilities don’t capture and remove CO2 from the atmosphere. They capture CO2 from gas streams at industrial facilities and use the CO2 in enhanced oil recovery operations and/or permanently geologically sequester the greenhouse gas underground.

A Canadian company, Carbon Engineering based in Squamish, B.C., was founded in 2009 and is a world pioneer in developing direct air capture technology. However, the company was sold last year for $1.5 billion to U.S.-based Occidental, a major petroleum company.

Carbon Engineering, with deployment partner 1PointFive, is now developing and will build its first commercial direct air capture facility in Texas.

The report notes that CDR has undergone rapid growth in research, public awareness and startup companies. Yet there are now signs of a slowdown in development across multiple indicators.

While investment in CDR research and startups is going to an increasing variety of novel methods, few of these methods are currently targeted in government policies and proposals to scale CDR, which accounts for just 1.1 per cent of investment in climate-tech startups, the report says.

“Given the world is off track from the decarbonization required to meet the Paris temperature goal, this shows the need to increase investment in CDR as well as for zero-emission solutions across the board,” Dr. Stephen Smith, of the Smith School of Enterprise and the Environment, University of Oxford, said in a statement.

The report notes that CDR companies have high ambitions which, taken together, would drive CDR to levels consistent with meeting the temperature goal of the Paris Agreement. However, the authors said these ambitions have little ground for credibility at present and depend on a much stronger set of policies than currently exists.

The report urges governments to implement policies that will increase demand for carbon removals. These should include the embedding of CDR policies into countries’ Nationally Determined Contributions (climate action plans under the UNFCCC) and developing better monitoring, reporting and verification systems for CDR.

At present, much of the demand for CDR is coming from voluntary commitments by companies to buy carbon removal credits.

“There are some encouraging signs in the growth and diversity of CDR research and innovations. But these are tempered strongly by sparse and precarious long-term demand,” Smith said. “Governments have a decisive role to play now in creating the conditions for CDR to scale sustainably."