Who owns Canada – and does it matter?

Peter Josty is the Executive Director of The Centre for Innovation Studies based in Calgary.

Peter Josty is the Executive Director of The Centre for Innovation Studies based in Calgary.

In 2022, enterprises operating in Canada held $17 trillion of assets in the country, according to Statistics Canada. This excludes government-owned enterprises as well as a number of smaller enterprises such as political and religious enterprises.

How much of this is foreign-owned? Who owns it? Which sectors are most heavily foreign- owned and in which provinces?

How many innovative companies are foreign-owned enterprises compared with Canadian-owned enterprises? Does foreign ownership really matter?

Overall foreign ownership

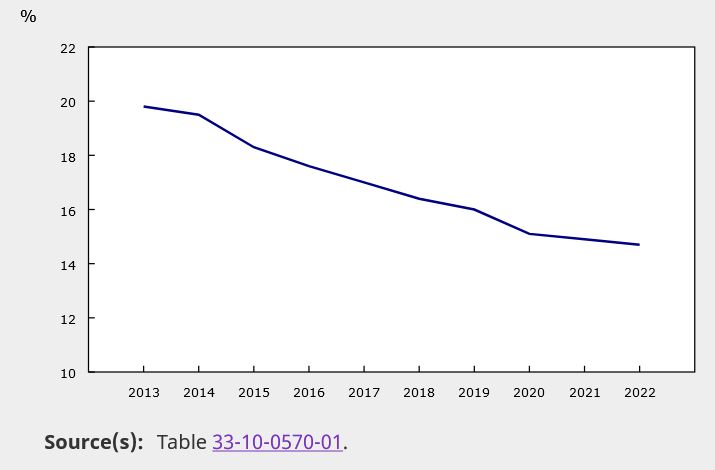

The graphic below shows that overall foreign ownership has been declining steadily over the last decade, from about 20 percent in 2013 to 14 percent in 2022.

Share of assets under foreign control, all industries, 2013 to 2022

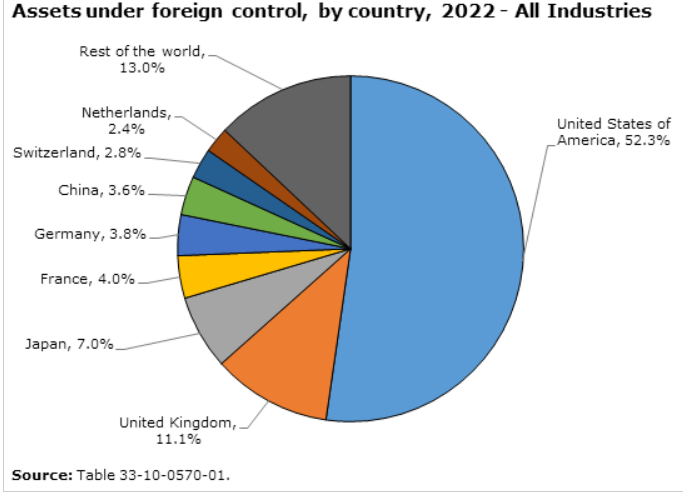

Which countries own the most?

The countries that control the largest proportion of foreign-owned assets in Canada are the U.S., the U.K. and Japan, which together own 70.4 percent of the foreign share.

Which industry sectors have the most foreign ownership?

The sectors with the most foreign control are: wholesale trade; non-depository credit intermediation; manufacturing; oil and gas extraction and support activities and mining and quarrying.

Control of assets (2022)

Type of Sector | Value of foreign control (in millions of dollars) | Percentage of foreign control |

Agriculture, forestry, fishing, and hunting | 282,929 | 3.1 |

Oil and gas extraction and support activities | 571,461 | 36.5 |

Mining and quarrying | 325,175 | 30.3 |

Utilities | 187,110 | 14.5 |

Construction | 526,665 | 5.6 |

Manufacturing | 1,238,159 | 44.1 |

Wholesale trade | 672,130 | 47.4 |

Retail trade | 397,417 | 21.1 |

Transportation and warehousing | 524,545 | 9.7 |

Information and cultural industries | 394,218 | 12.4 |

Real estate and rental and leasing | 1,058,390 | 5.6 |

Professional, scientific, and technical services | 452,581 | 26.5 |

Administrative and support, waste management and remediation services | 152,743 | 14.6 |

Educational, health care and social assistance services | 186,749 | 1.7 |

Arts, entertainment, and recreation | 43,311 | 21 |

Accommodation and food services | 104,391 | 12.6 |

Repair, maintenance and personal services | 78,247 | 11.7 |

Total non-financial industries | 7,196,224 | 23 |

Non-depository credit intermediation | 342,676 | 45.4 |

Insurance carriers and related activities | 1,280,280 | 11.7 |

Other financial industries | 1,813,147 | 12.5 |

Depository credit intermediation | 6,387,472 | 4.9 |

Total finance and insurance industries | 9,823,575 | 8.6 |

Total all industries | 17,019,799 | 14.7 |

Source: Table 33-10-0570-01, Statistics Canada

Does it matter?

There are many ways to look at the impact of foreign ownership on a business in Canada.

From an economic welfare point of view, whether a Canadian business is owned or controlled by a foreign firm does not matter much. The business will contribute to Canadian GDP and the well-being of Canadians. Canadians will earn wages and salaries, pay income and property taxes, use local services, etc.

For example, while much of the share ownership of Tim Hortons is in Brazil and the U.S., each location is a franchise owned locally. So, most of the benefits are local.

If you buy a Chinese-made appliance it doesn’t make much difference if the retailer is Canadian-owned or not.

From a strategy perspective, foreign ownership means that big strategic decisions are not made in Canada. So, decisions about whether to open or close a plant, enter a new line of business and other major decisions are made elsewhere.

A recent example is Hudson’s Bay, where a U.S. real estate developer bought the company, stripped it of its assets and didn’t invest in the business, resulting in its bankruptcy.

From a balance of payments perspective, the effect of foreign ownership is mostly quite small.

For instance, if a typical retailer has a profit margin of two to three percent (net income after tax as a percentage of revenue), then its dividend paid to the foreign owner will almost always be less than that. This will be offset by the foreign direct investment used to build or buy the Canadian business.

The big exception here is Ireland, which made a huge push to get U.S. multinationals to locate their European offices there. Dividend payments to foreign, mostly U.S., owners are huge, resulting in a large balance of payments deficit in Ireland.

From a research and development perspective, the impact is positive. In theory there is a “head office effect” that means that R&D centres are often located close to corporate headquarters. For foreign-owned firms this would mean near the foreign headquarters – so reducing R&D in Canada.

However, empirically, foreign- owned firms in Canada spend more on R&D than Canadian owned firms. Foreign owned firms spent $13.8 billion on R&D in Canada in 2023, while Canadian owned firms spent $9.8 billion, according to Statistics Canada.

Lack of “head office” training

There is a significant positive “head office” effect that is absent from foreign-owned multinationals. Head offices usually house departments working in strategy, corporate finance, legal, investor relations and other areas that are usually absent from branch plant offices.

The absence of this positive impact in foreign-owned firms reduces the potential for Canadians to get experience in these areas and contribute to other businesses later in their careers.

When it comes to community involvement, there is significant anecdotal evidence that firms spend much of their corporate sponsorships near their headquarters.

Here’s just one example: In Midland, Michigan, the headquarters of Dow Chemical, there have been extensive investments by the company and by the founder’s foundation in numerous education facilities across Michigan. These have been extensively reported in local media. These are much greater than the investments made by the Canadian head office in Sarnia, Ontario.

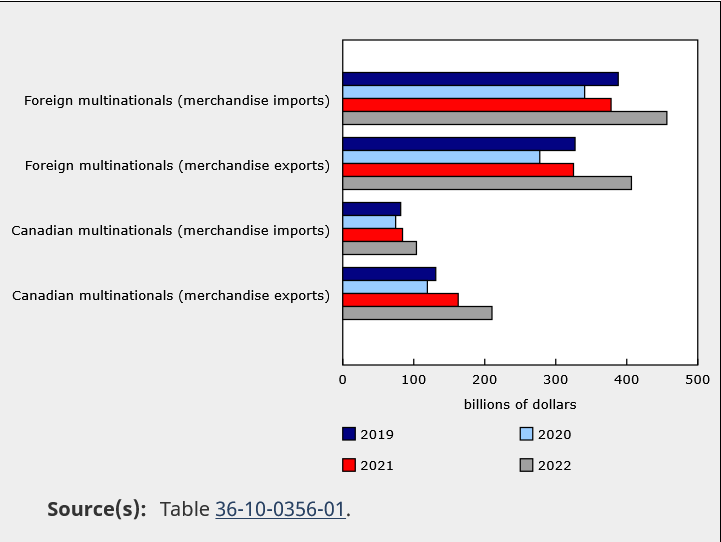

From an import and export perspective, foreign-owned multinationals dominate Canadian merchandise imports and exports. See the graphic below.

Source: Statistics Canada

Conclusion

The impact of foreign ownership on Canadian firms is complicated.

From an economic welfare point of view, it doesn’t matter much. Canadians operate the business, pay taxes and the business contributes to Canada’s GDP.

Foreign-owned companies also spend more on R&D than Canadian-owned companies and often bring their own proprietary technology.

On the negative side, foreign ownership deprives Canadians of valuable experience in areas such as strategy, corporate finance, legal and investor relations, which are typically done at the head office.

Foreign-owned multinationals usually import more than they export, creating a negative trade balance, and they invest less in the local community.

The most significant drawback of foreign ownership is that major strategic decisions are made outside Canada. These include decisions about selling the business, expanding capacity (or not), entering or exiting lines of business, and investing in the business. The fate of Hudson’s Bay is the latest example.

R$

| Organizations: | |

| People: | |

| Topics: |

Events For Leaders in

Science, Tech, Innovation, and Policy

Discuss and learn from those in the know at our virtual and in-person events.

See Upcoming Events

You have 0 free articles remaining.

Don't miss out - start your free trial today.

Start your FREE trial Already a member? Log in

By using this website, you agree to our use of cookies. We use cookies to provide you with a great experience and to help our website run effectively in accordance with our Privacy Policy and Terms of Service.